Blog

Can I invest in commercial real estate?

Can I invest in commercial real estate?

So, you've learned a bit about the basics of real estate investing and are starting to see how much work your money could do for you. Before investing in apartment complex syndications, it is important to understand the rules. There are some differences based on what type of deal and what the SEC allows for various investors.

Let's review the definition of a syndication offering. This will help you better understand what a deal with Desert Lily Properties involves. So, you have a collection of investors, and they pool funds into a single property managed by partners who have sourced the deal. Congratulations, you have created a security according to the Security and Exchange Commission (SEC). As such, these offerings are strictly monitored. They are only open to individuals who meet the criteria as an accredited or sophisticated investor.

An accredited investor is free to invest in any syndication offered so long as they are able to raise the capital needed by the terms of that deal. To become an accredited investor, you must certify that you meet one of the following criteria.

Option A: Have a yearly gross income of $200,000 (single) or $300,000 (married) that has been maintained over the two most recent years. In this option, you also need to be confident that the level of income will be maintained or increased during the current year.

Option B: Have a net worth (either single or jointly if married) that exceeds $1,000,000. Your net worth is calculated excluding the primary residence of the investor.

There are other ways to become an accredited investor, but they are not commonly used. One path is to be a financial professional with Series 7, 62, or 65 licensing. Another is through managing a trust containing over $5 million in assets. You may also qualify for working as a director or executive in a company that issues securities for sale.

If you have investing knowledge and expertise but do not meet the requirements of an accredited investor, you may be a sophisticated investor. There are no specific requirements to become a sophisticated investor like there are for accredited investors. However, the SEC defines non-accredited (sophisticated) investors "as those investors with sufficient knowledge and experience in financial and business matters to make them capable of evaluating the merits and risks of the prospective investment" (www.investopedia.com/terms). This opens up investing into deals that may have only been available to those with substantial financial means, to those who may have knowledge but not as much funds.

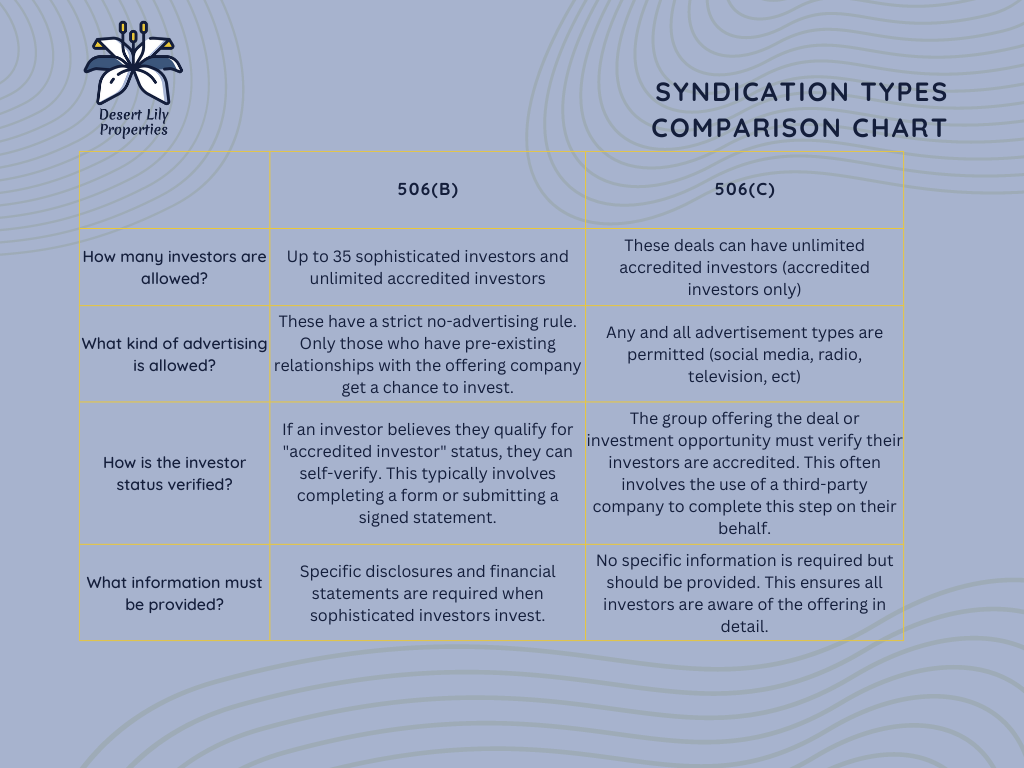

Understanding what you qualify as becomes vital due to differences in what kinds of offerings the SEC allows. In the multifamily syndication space, you will find either a 506(b) or 506(c) deal looking for investment. Many of the rules that govern these two types are the same, but there are key differences to be aware of. The chart below highlights the critical differences between the two offerings.

After reviewing the differences, most potential investors will have two more questions. The most frequent questions are "Do I have to prove that I qualify?" and "What happens if I lie?".

These questions generally apply to 506(b) offerings. 506(c) offerings have more rigorous checks to verify your qualifications up front. If you do decide to provide false statements to enter an offering, it is on the group assembling the investment opportunity. If you are suspected of providing dishonest information, it is on those managing the investment to keep you out. They are responsible for complying with current laws governing securities. Additionally, there may be laws (state dependent) allowing for any non-accredited investors to back out. This may be during a set time period or at any time during the investment.

The SEC created these investor categories to protect people who want to take part in syndications or securities. Both categories of investor help ensure that only those with enough knowledge risk their money. It is very common for syndications to require certain forms are signed. These forms prevent investors from taking against the group governing the security.

Once an investor has provided a signed statement, any repercussions or money lost in the investment is entirely on the investor. Investors must prove their status and generally sign away rights to complain about lack of qualifications. For this reason, we encourage any and all potential investors to be transparent. Are you unsure what type of investor you are? Schedule a call with us or submit an information request. We are always happy to answer questions for any interested investors.

References

https://ascentlawfirm.com/can-i-lie-about-being-an-accredited-investor/

https://www.investopedia.com/terms/s/sophisticatedinvestor.asp

https://willowdaleequity.com/blog/am-i-an-accredited-non-accredited-or-sophisticated-investor/

https://www.sec.gov/education/capitalraising/building-blocks/accredited-investor

Learn How To Become An Investor With Us

We welcome inquiries from investors seeking multifamily investment opportunities.

Helpful Links

Contact Information

Location: 2550 E. Rose Garden Lane #71235 Phoenix, AZ 85050

Phone : (662) 505-5036

Email : info@desertlilyproperties.com

© 2023 Desert Lily Properties All Rights Reserved.

© 2023 Desert Lily Properties. All Rights Reserved.